Friday, June 25, 2021

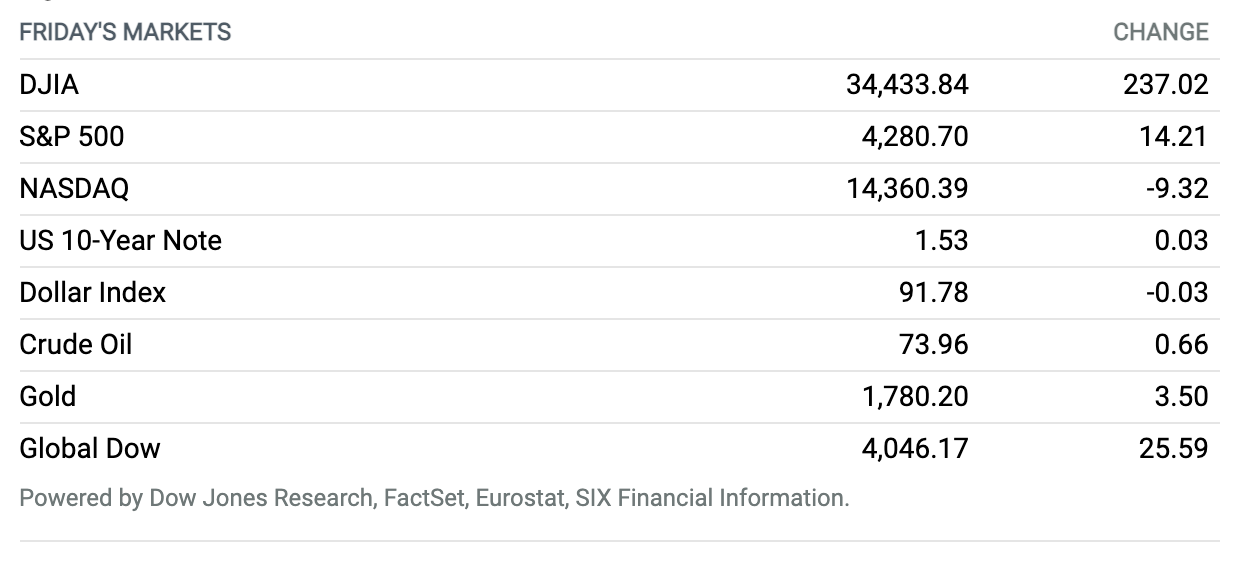

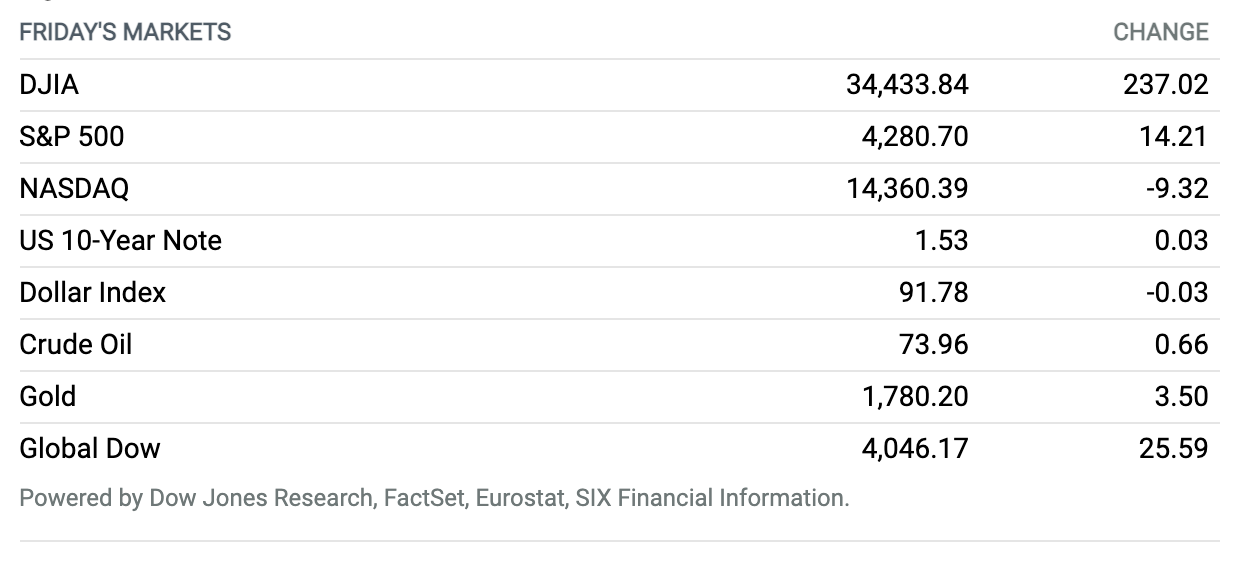

S&P Sets Record as Stocks Close Mostly Higher. Stocks ended mostly higher Friday, capping a week of gains that saw the S&P 500 and Nasdaq Composite set records as investors erased a pullback that followed a more hawkish tone from the Federal Reserve. The Dow Jones Industrial Average rose 0.7% to finish near 34,434. The S&P 500 advanced around 0.3% to close near 4281, finishing at a record for a second straight session and logging a weekly rise of 2.7%, its strongest since the week ended Feb. 5, according to Dow Jones Market Data. The Nasdaq Composite pulled back slightly from the latest in a string of records set Thursday, losing around 0.1% to end near 14,360. The Dow rose 3.4% for the week, while the Nasdaq gained 2.4%.

Stagnant Spending Belies Consumer Strength, but Inflation Worry Is Percolating

The Bureau of Economic Analysis said Friday that spending was unchanged compared with April as personal income fell 2%. Economists saw the decline in income coming and expected a sharper 2.8% rate of decline. The spending drop was a surprise—economists predicted a 0.4% increase in outlays last month—but most say underlying consumer strength remains intact.

“Both capture the fading of the impact of the stimulus payments made under the March Covid bill,” says Pantheon Macroeconomics’ Ian Shepherdson of the income and spending numbers. “We expect the underlying upward trends to re-emerge over the next couple months, when the reopening of the economy and the rebound in employment will become the dominant forces,” he says.

Within the BEA’s income and spending report is the personal consumption expenditure index, the Federal Reserve’s preferred inflation metric. The good news: the PCE in May versus April rose at a slightly slower pace than economists projected. The not-so-good news: from a year earlier, the PCE is up 3.9%, marking the fastest clip since August 2008.

Continue reading ›

Biden Says an Infrastructure Deal Has Been Reached

President Biden announced Thursday that he has come to an agreement with a group of Republican Senators on an infrastructure package of roughly $600 billion.

“We’re in a race with China and the rest of the world for the 21st Century. They are not waiting,” Biden said in remarks he made Thursday afternoon.

Continue reading ›

The Largest U.S. Retirement Plan Will Offer ESG Funds

The federal government’s Thrift Savings Plan will begin offering environmental, social, and governance funds in 2022, the latest sign of the growing acceptance of sustainable investing by retirement plans.

The ESG funds will be available in a new “mutual fund window,” similar to a brokerage option, for the plan, a Thrift Savings Plan spokesperson told Barron’s.

Continue reading ›

Why It Will Be Hard for China to Clamp Down on Bitcoin

Bitcoin’s founders wanted a decentralized system impervious to government control. Now they are facing their ultimate test: The People’s Republic of China.

Bitcoin’s price plunged 16%, then rallied most of the way back following a June 21 declaration from the Chinese central bank that cryptocurrencies “disrupt financial orders, breed criminal activity, and seriously infringe property safety,” among other evils. That followed a sit-down where the country’s banks and payments systems promised to do better squeezing out crypto business.

Continue reading ›

U.S. Business Activity Growth Eases in June, IHS Markit Says

U.S. private-sector business activity continued to expand at a solid pace in June amid boosted new orders, but it softened compared with the record high registered in May.

The flash reading for the U.S. Composite Output Index decreased to 63.9 in June from 68.7 in May, according to preliminary data from IHS Markit released Wednesday.

Continue reading ›

Tech Antitrust Bills Gain Traction in Washington

Antitrust efforts aimed at big tech companies like Google’s parent Alphabet, Apple, Amazon.com, and Facebook are gaining steam in Washington.

The House Judiciary Committee approved a six-part bill package on Thursday, paving the way for the full House and Senate to consider the legislation.

Continue reading ›

Home Prices Hit Record High as Sales Decline for Fourth Month in a Row

The median sales price of an existing home grew 23.6% annually in May to a record $350,300, according to data released this week.

The National Association of Realtors reported that the median sale price of a home in May rose at the greatest year-over-year pace since at least 1999, up from $283,500 last year and $340,600 in April. The price increase comes as high buyer demand and scarce homes for sale have fueled a highly competitive housing market.

Continue reading ›

Buybacks and Dividends Are on the Way as Banks Pass Fed Stress Tests

Get ready for banks to give cash back to shareholders.

In an announcement that surprised absolutely no one, the Federal Reserve announced that all 23 banks that took this year’s stress test easily passed, paving the way for a sharp increase in buybacks and dividends. Investors will have to wait until after the close of trading on Monday to see how much cash banks will be handing out.

Continue reading ›

Supreme Court Rebuffs Most Claims by Fannie, Freddie Investors

Traders who were looking to the Supreme Court for assistance in their fight to wring some profit out of their positions in government-sponsored mortgage guarantors Fannie Mae and Freddie Mac just got rebuffed.

This week, the Supreme Court mostly shot down the argument that the Federal Housing Finance Agency, the overseer of Fannie and Freddie, had overstepped its authority in requiring variable dividend payments to the Treasury Department. Those payments—the result of a 2012 FHFA decision—mean the two enterprises must funnel all their net worth to the Treasury above a predetermined capital reserve.

Continue reading ›

Southwest Names New CEO as Airline Ramps Up for Post-Covid Travel

Southwest Airlines plans to pass the CEO baton, naming a senior executive, Bob Jordan, to replace longtime chief executive Gary Kelly in February 2022.

Jordan, 60, joined Southwest in 1988 and has held a variety of management roles, most recently overseeing the company’s voluntary-leave program. He previously handled Southwest’s acquisition of AirTran Airways, and led projects including the development an e-commerce platform and the airline’s Rapid Rewards mileage program.

Continue reading ›