Friday, June 12, 2020

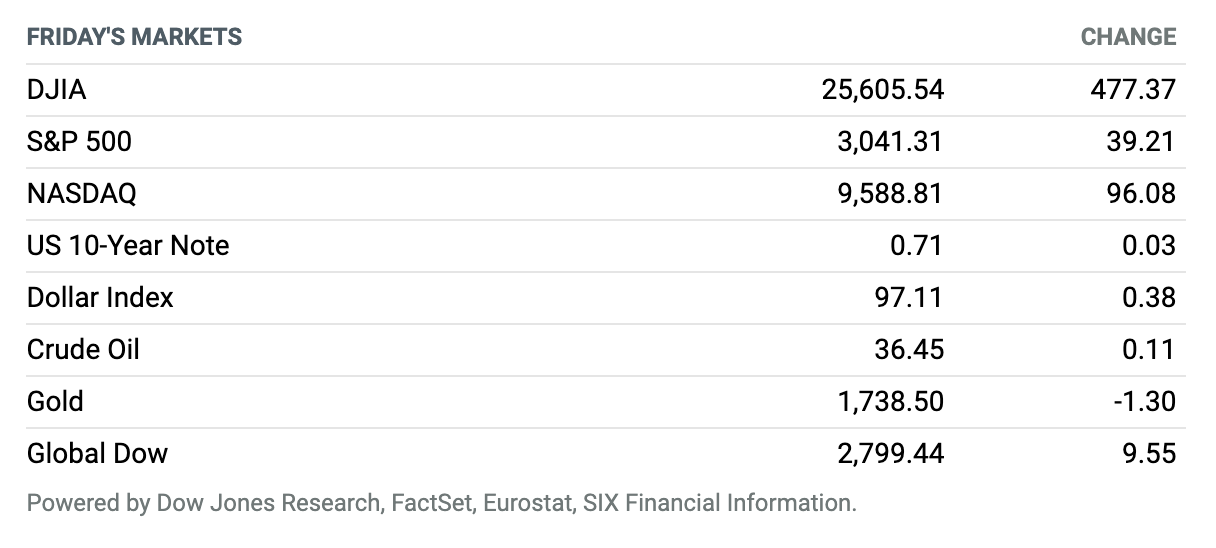

Rough Week. U.S. stocks finished higher on Friday, but down sharply for the week, after the market attempted to find stable footing following the biggest one-day selloff since mid-March. The S&P 500 rose 1.3% to close near 3041. The Dow Jones Industrial Average advanced 477 points, or 1.9%, to finish around 25,606, based on preliminary numbers. The Nasdaq Composite gained 1% to end near 9589. For the week, the S&P 500 declined 4.8%, the Dow fell 5.6%, and the Nasdaq Composite was off 2.3%. Investors are assessing the state of the market amid worries that a second wave of Covid-19 infections was hitting some U.S. states that had been largely spared when the disease first spread across the country. Meanwhile, Richmond Federal Reserve President Thomas Barkin and the International Monetary Fund’s chief economist Gita Gopinath pointed to the tough road ahead for the U.S. and global economy.

Fed Sees Rates Near Zero Through 2022, Vows to Do What’s Needed for Economy

The Federal Reserve’s policy-setting arm on Wednesday assured investors that interest rates will remain at rock bottom through 2022 and reiterated that it stands ready to do more to support the U.S. economy as it weathers the coronavirus pandemic and efforts to contain it.

“The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals,” said the statement released at the conclusion of the Fed’s latest policy meeting.

The Fed Is Optimistic About the Recovery—If Congress Does More Now

Many people seem to have missed it, but Federal Reserve officials are optimistic about the postcrisis prospects for the U.S. economy. In their latest projections for growth, unemployment, and interest rates, America’s monetary policy makers all believe the “longer run” outlook looks exactly the same as it did back in December despite everything that’s happened over the past six months. According to them, the trauma of the virus won’t leave a permanent mark on the U.S. economy.

That optimism, however, is predicated on the willingness of Congress to do more. If Congress declares victory prematurely or reins in spending as deficits blow up, Fed Chairman Jerome Powell warned on Wednesday, millions of Americans will “lose contact with the labor force” and “a lot of perfectly good businesses [will] go out of business permanently.” Despite disbursing trillions of dollars, the Cares Act just wasn’t enough, which is why Powell says the U.S. economy “probably will need further support” to avoid long-term damage.

Epidemiologists Fear ‘Stuttering, Endless Loop’ of Covid-19 Infections

Thursday’s steep 6% drop in the S&P 500 was diagnosed as a chill from the rising case counts of Covid-19 in a number of states, after their reopenings from pandemic lockdown. Texas, Florida and Arizona are seeing an uptick in their per capita Covid cases and filling more hospital beds. Pools are drawing crowds, and President Donald Trump has asked attendees of his indoor rallies to legally absolve his campaign of blame if the gatherings spread the coronavirus.

Epidemiologists say Americans shouldn’t drop their guard. Harvard epidemiology professor Marc Lipsitch notes that most states are reopening with the pandemic less well-controlled than were the cases in Europe and East Asia. “I think this is risky from a virus perspective,” he told Barron’s, in an email. “I expect several more places will have their health care systems badly challenged in the U.S.”

Jobless Claims Continue to Trend Lower, Adding to Signs of Labor Recovery

The number of Americans filing first-time claims for unemployment benefits fell in the latest week, continuing a downward trajectory that provides further evidence that the labor market is starting to recover after the coronavirus crisis.

In the week ended June 6, the Labor Department reported 1.5 million initial claims on a seasonally adjusted basis, down from an upwardly revised 1.9 million the week before. The four-week moving average was 2 million, down from 2.3 million the week prior.

Grubhub Is Being Bought by Amsterdam-Based Just Eat

Grubhub has reached an agreement to be acquired by Amsterdam-based Just Eat Takeaway.com in an all stock deal valued at $75.15 a share, or a total of $7.3 billion. The acquisition will create the world’s largest online food delivery company outside China as measured by revenues and gross merchandise value. Grubhub is currently the third-largest food delivery company in the U.S., behind UberEats and DoorDash.

“Grubhub is the best food delivery company in the U.S. and it is the only one which is culturally similar to Just Eat Takeaway.com,” the company said in a press release announcing the deal.

Key Boeing Supplier Said It Was Told to Halt 737 MAX Work

The on-again, off-again Boeing 737 MAX drama continues. A key supplier was asked to halt work related to the grounded plane, potentially putting the existing timeline for its reintroduction to service, as well as total deliveries expected in 2020 and 2021, at risk.

Spirit AeroSystems said on Wednesday evening that it received a letter from Boeing on June 4 directing the company to “pause additional work on four 737 MAX shipsets and avoid starting production on 16 737 MAX shipsets to be delivered in 2020.” Spirit makes a lot of the fuselage of a 737 MAX jet, and the plane is its largest aircraft program. A shipset refers to all the work done on one MAX jet by the supplier.

Moderna Will Start Testing Its Covid-19 Vaccine on 30,000 People in July

The biotech startup Moderna says it will begin the pivotal trial of its candidate vaccine against Covid-19 in July. In a Thursday morning announcement, it said it hopes to enroll 30,000 volunteers—randomizing them to receive either a placebo or the vaccine, and a second booster shot one month later. Researchers will then watch to see how many in each group contract Covid as they go about their lives over the subsequent year.

Shares of Moderna have soared and stooped on gusts of hope for a vaccine to end the Covid pandemic. The stock was up threefold for the year at Wednesday’s closing price of $60.

Regeneron’s Antibody Cocktail Against Covid Starts Human Trials, With Encouraging Data

While we await a successful vaccine to stop Covid-19, a useful stopgap preventive has also begun human clinical trials. Regeneron Pharmaceuticals said Thursday morning that it is starting the first tests of a cocktail that combines two antibodies that could block the SARS-CoV-2 virus from entering our cells. Infusions of the cocktail might protect health-care workers, first responders, or housemates of infected patients, and perhaps prevent dire symptoms in those already infected.

Even if a vaccine emerges from clinical trials, sometime next year, Regeneron’s co-founder and chief scientist George Yancopoulos said in the announcement that an antibody cocktail might be ready sooner and work better than a vaccine among the elderly and others with weak immune systems.

It’s Official: The U.S. Economy Entered Recession in February

The slow and steady recovery from the financial crisis was America’s longest stretch of more-or-less uninterrupted growth ever recorded. Now it’s officially over.

The National Bureau of Economic Research announced on Monday that the U.S. economy reached “a peak in monthly economic activity” in February, which “marks the end of the expansion that began in June 2009 and the beginning of a recession.” That shouldn’t be news to anyone, given the unprecedented collapse in jobs, production, and spending over the past few months, but the NBER has been the self-appointed chronicler of American business cycles since 1929.

Vroom Shares Rocket on Trading Debut

Shares of the online used-car service Vroom began trading on Tuesday with a roar, opening 83% higher and becoming the latest hot initial public offering.

The stock opened on the Nasdaq market at $40.25, up from its IPO price of $22. In early afternoon trading Tuesday, it was at $45.69, up 107.7%. The size of the IPO had been increased to 21.25 million shares from 18.75 million shares. And the pricing had come in above a revised range of $18 to $20 a share. The first price range indication had been $15 to $17 a share.