Friday, January 28, 2022

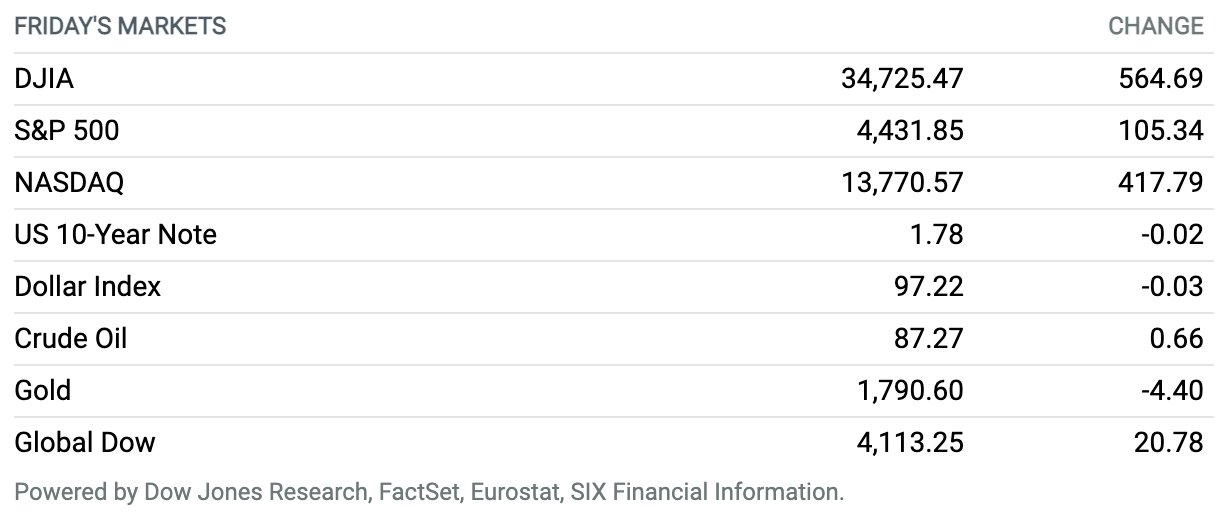

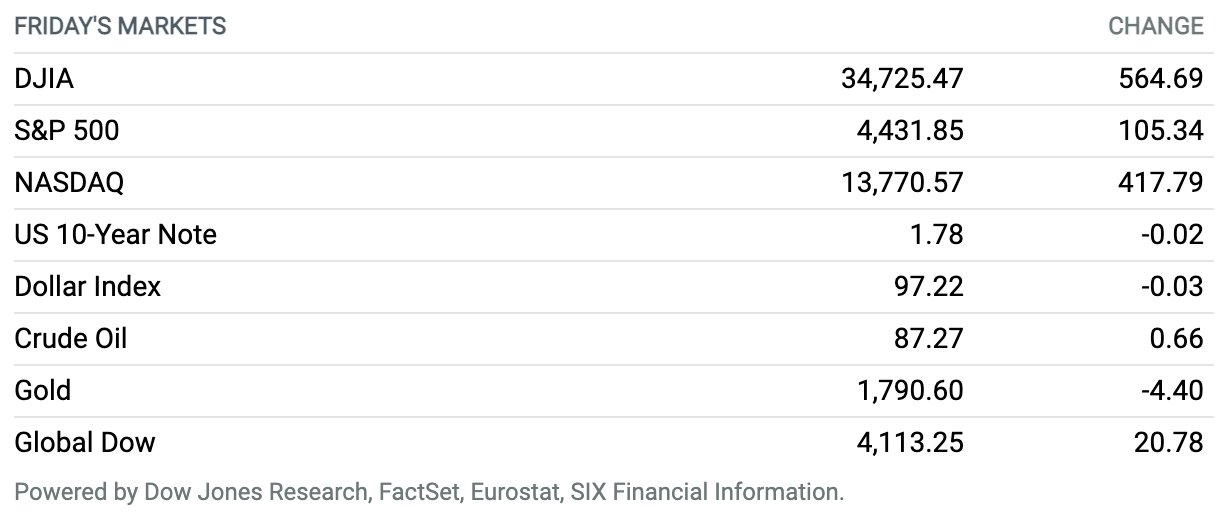

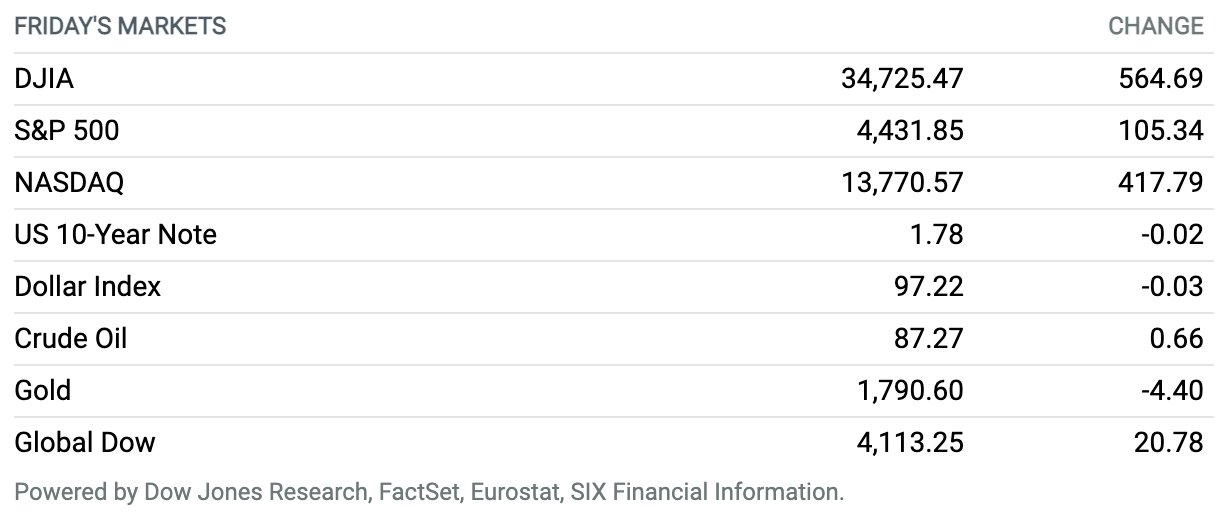

Stocks End Friday Higher, Cap a Wild Week With Modest Gains. A big comeback Friday for stocks left the S&P 500 index, Dow Jones Industrial Average, and Nasdaq Composite index with sizable gains on the session and enough upward momentum to leave all three key U.S. stock benchmarks in the green in a week of extreme volatility on Wall Street. The S&P 500 rose 105 points Friday, or 2.4%. The Dow ended the day up 565 points, or 1.7%, while the Nasdaq gained 418 points, or 3.1%. For the week, the S&P 500 rose 1.3%, while the Dow rose 0.8% and the Nasdaq was flat, and still in correction territory. Despite Friday’s upswing for equities, January still looks to be a punishing month for stocks, as investors prepare for the Federal Reserve to potentially hike rates for the first time since 2018 in March, and thereafter start to rein in its near $9 trillion balance sheet.

Consumer Spending Slumps as U.S. Inflation Continues to Rise Sharply

U.S. consumer spending slowed in December as inflation continued to skyrocket, taking a bite out of holiday spending.

The personal consumption expenditures price index, which is the Federal Reserve’s preferred measure of inflation, increased by 0.4% in December, for a 5.8% year-over-year increase, according to data from the Bureau of Economic Analysis. It’s the highest figure since 1982, reflecting increases in both goods and services.

Core inflation, which strips out food and energy to make underlying inflation easier to see, rose 4.9% on a yearly basis, slightly above economists’ expectations of a 4.8% increase.

Continue reading

Fed Plans Rate Liftoff for March, and Then Significant Balance-Sheet Shrinkage

The Federal Reserve this week confirmed what market watchers already knew: Interest rates will start to rise in March just as the central bank’s emergency bond-buying program fully concludes.

Officials also offered new, if vague, details on their plans to shrink the Fed’s $9 trillion balance sheet, which has doubled since the start of the pandemic and represents nearly 40% of U.S. gross domestic product.

Employers’ Labor Costs Slowed a Bit in 4th Quarter. The Relief May Be Fleeting.

Friday’s economic data offer one small, reassuring sign relative to the monetary policy tightening cycle that is about to begin: Wages might not be about to spiral.

The Employment Cost Index, a quarterly metric that captures total employee compensation as opposed to only wages, is the least volatile and highest-quality labor-cost indicator, says Josh Shapiro, chief U.S. economist at MFR—and it’s showing some moderation.

Continue reading

Google Plans $1 Billion Investment in Partnership With India’s Bharti Airtel

Alphabet’s Google plans to invest up to $1 billion in a multi-year partnership with Bharti Airtel to help accelerate the growth of India’s digital economy.

Google plans to take a 1.28% stake in the Indian telecom company for $700 million. It also will invest up to $300 million for potential commercial initiatives to boost Bharti Airtel’s offerings and improve access in India’s digital services, the companies said Friday.

Continue reading

Consumer Sentiment Shows Weakness in Latest Survey

The University of Michigan consumer sentiment survey‘s numbers for January fell to 67.2, the lowest reading since November 2011, and a sign that inflation and the Omicron variant have stymied consumer spending.

Measurements for the Michigan data are designed to capture the mood of American consumers and signal information about near-term consumer-spending plans. Earlier this month, preliminary data for the survey fell to 68.8 in the second-lowest level in a decade and below the FactSet forecast of 70.0. Final projections for January sat at 68.2, according to FactSet. The final reading for December was 70.6.

Continue reading

The White House Is Ignoring Tesla. Elon Musk Pushes Back on Twitter.

The strange but often entertaining beef between the Biden administration and Elon Musk’s company Tesla took another turn Thursday.

President Joe Biden praised General Motors again as an electric-vehicle leader in a video with GM CEO Mary Barra. Musk responded—on Twitter, of course.

Continue reading

Caterpillar Beats Earnings Estimates. Supply-Chain Issues Aren’t a Problem.

Caterpillar reported better-than-expected fourth-quarter numbers on Friday, indicating that it managed to deal with supply-chain issues and inflation successfully.

Caterpillar reported $2.69 in adjusted per-share fourth-quarter earnings from $13.8 billion in sales. Analysts were looking for earnings of $2.27 a share from $12.6 billion in sales. A year ago, Caterpillar reported $2.12 in per-share earnings from $11.2 billion in sales.

Continue reading

Toyota Remains World’s Top Car-Seller Despite Chip Disruptions

Japan’s Toyota Motor has maintained its position as the world’s biggest car seller, beating German rival Volkswagen for the second year in a row, despite chip shortages and Covid-19-related supply-chain disruption.

Toyota said Friday it sold nearly 10.5 million vehicles in 2021, an increase of 10.1% from 2020, including those for subsidiaries Daihatsu Motor and Hino Motors.

Continue reading

Boeing Might Be Making a New Plane

Boeing might be on the cusp of an all-new airplane.

Boeing commercial airplanes chief Stan Deal reportedly told the Royal Aeronautical Society this week that his company was in the early stages of developing a new plane. Early stages can involve probing customers about interest in a new aircraft as well as thinking through questions about plane size and new design features.

Continue reading

LVMH Profit Soars Above Prepandemic Levels

LVMH Moët Hennessy Louis Vuitton‘s sales jumped 44% in 2021 to €64.2 billion ($71.5 billion), the French luxury conglomerate said this week. Organic revenue was 14% above the level of 2019, before the coronavirus pandemic.

Profit from recurring operations more than doubled last year to €17.15 billion, the group said in a release—49% higher than in 2019.

Continue reading